OCR-powered expense filing + GST compliance + Multi-level approval system + Mileage tracking

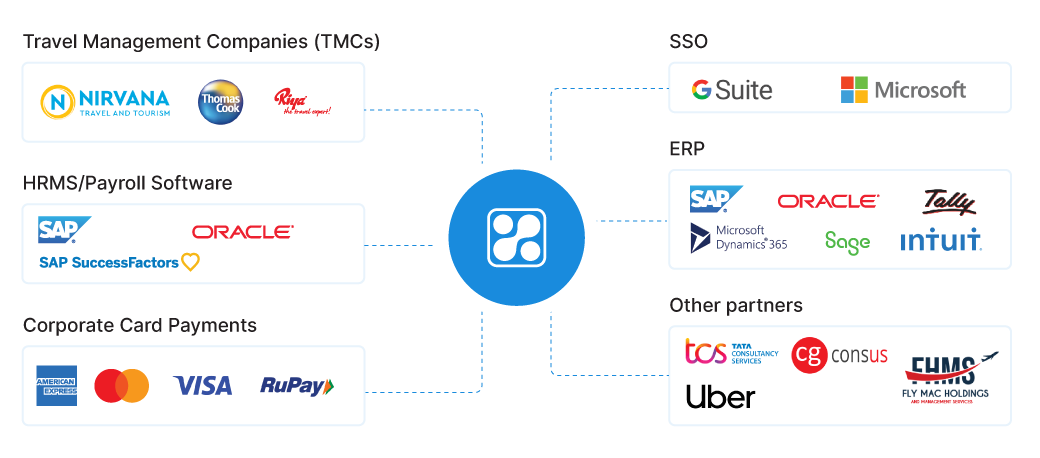

+ Corporate cards + ERP + Travel booking + Petty cash mgmt

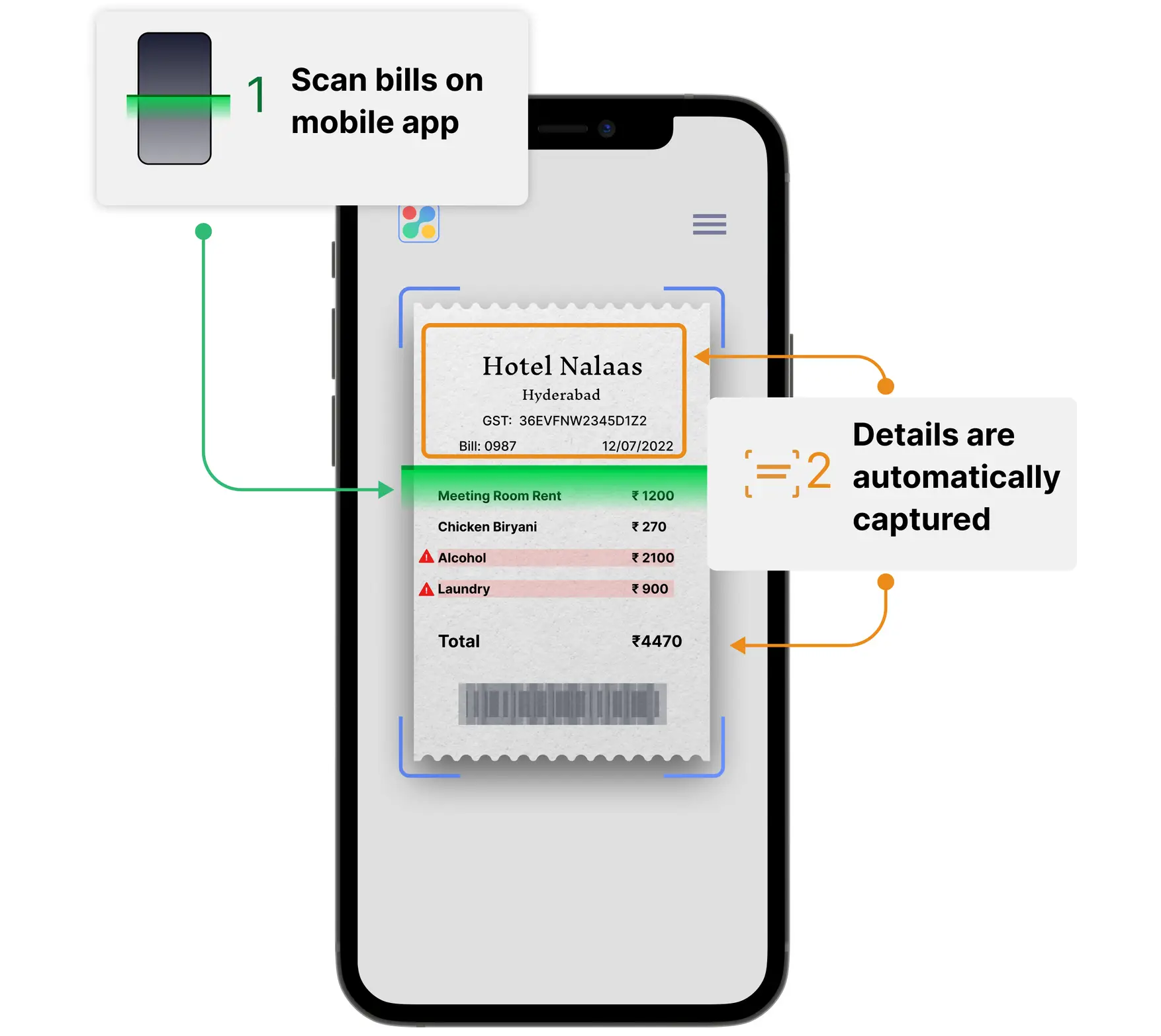

The OCR-powered mobile app empowers

corporate travellers to scan physical and digital

invoices during the trip itself.

The tool accurately captures the Amount, GSTIN,

Vendor name, Date, City and Invoice number

from the invoices.

Expense data from multiple platforms like

Credit card statements, SMS, Gmail, Outlook, Uber is captured and pushed into the Happay expense portal directly.

This ensures high data accuracy and eliminates manipulation.

Happay’s Smart audit leaves no room for duplicate invoices, claims above eligibility, non-compliant items, or invoice mismatches.

Finance team can reduce up to 80% of the effort involved in the verification of expense reports.

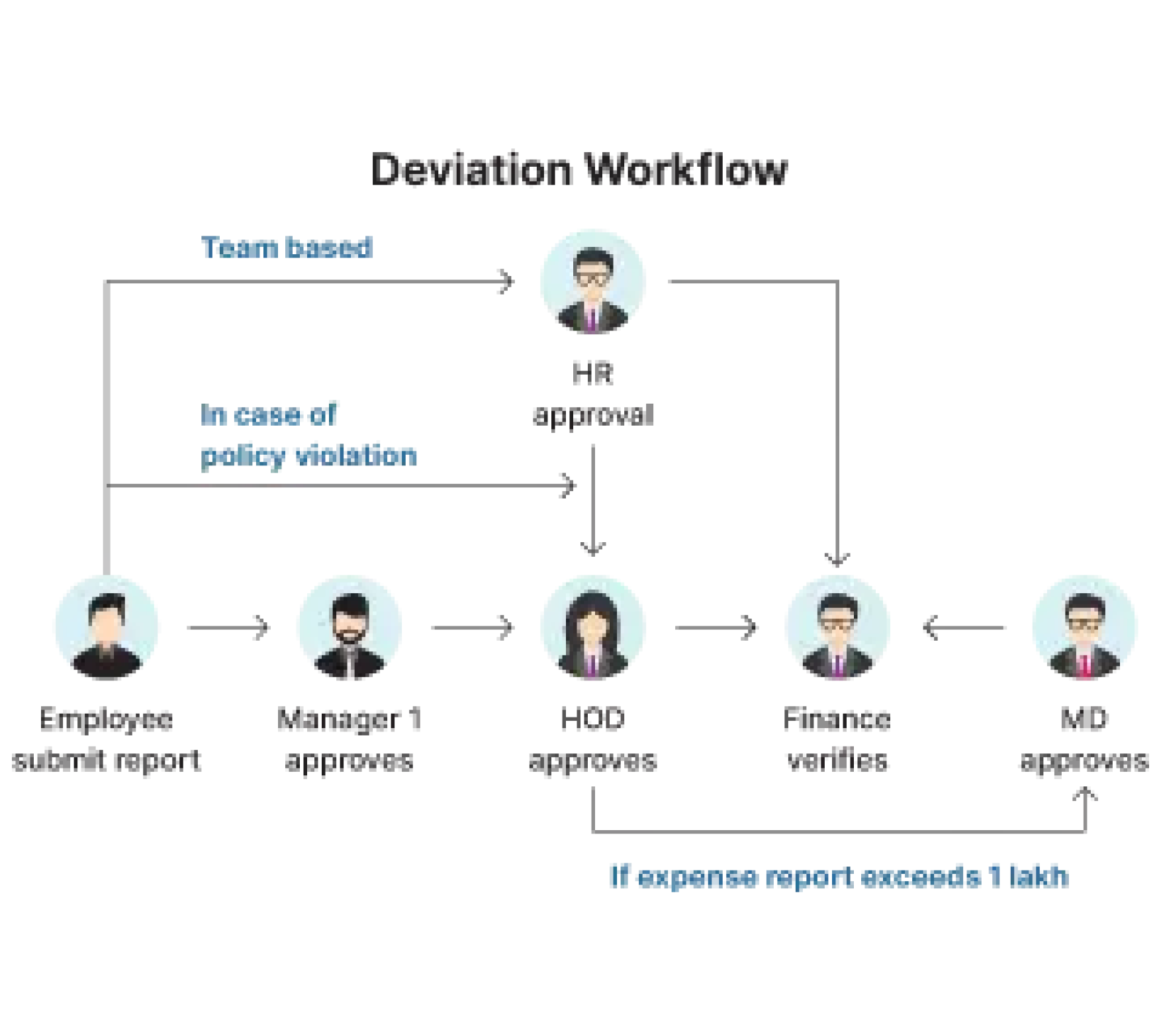

From multi-level hierarchy to special approvals in case of policy violations, setup once and let it run seamlessly.

The OCR-powered mobile app empowers

corporate travellers to scan physical and digital

invoices during the trip itself.

The tool accurately captures the Amount, GSTIN,

Vendor name, Date, City and Invoice number

from the invoices.

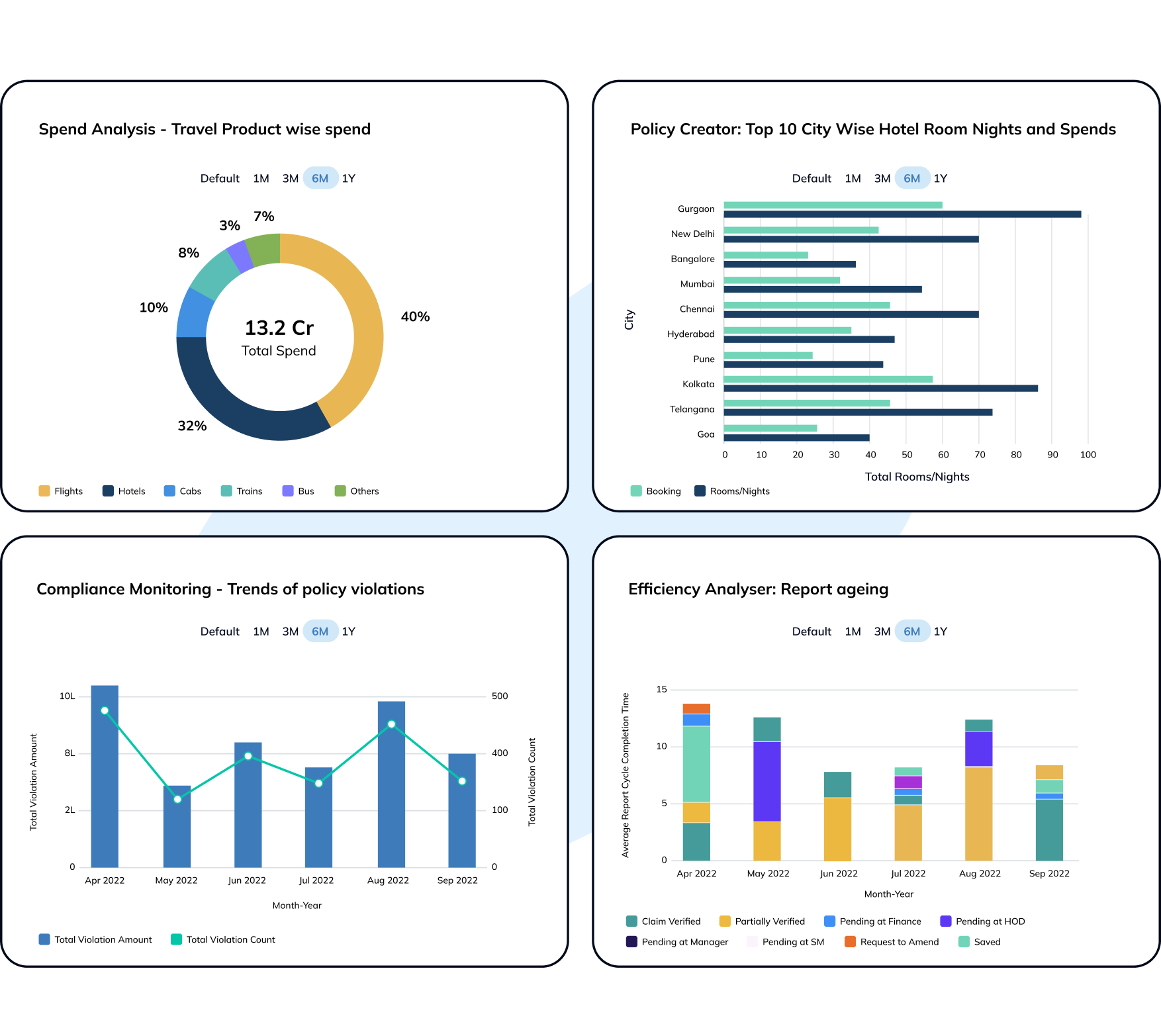

Smart analytics gives a clear vision of the cash flow leading to better budgeting and decisions.

Identify spend leakages and process inefficiencies with reports like:

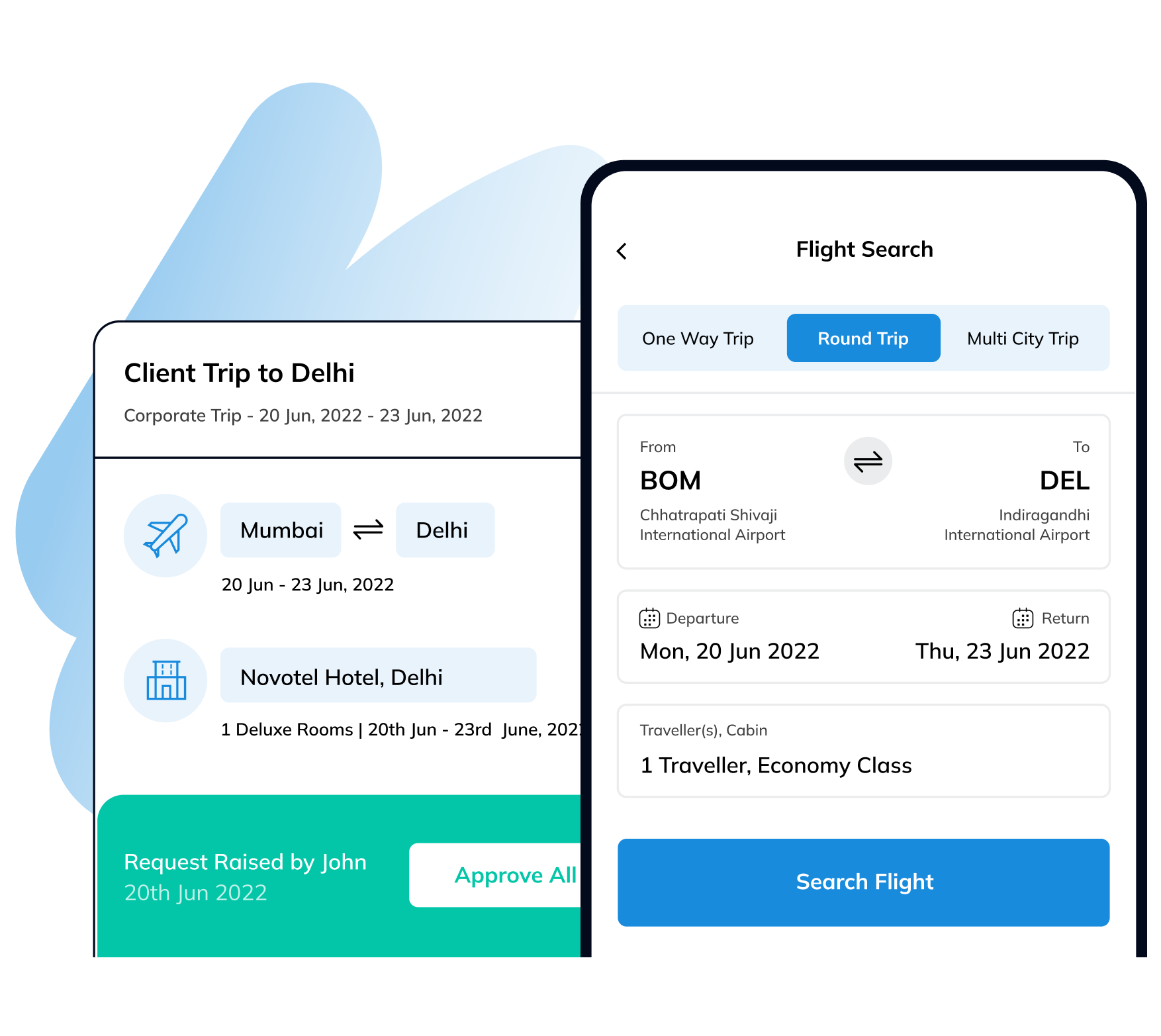

From Travel booking to GST compliance, perform it all in one platform.

Travel admins can book trips using virtual prepaid cards. This simplifies the reconcillation of transaction data vs booking data.

Travellers can make all expenses using cards. This enables real-time spend visibility, enforces policy controls, and ensures automated reconcillations.

Auto captures vendor GSTIN and split-up from airline and hotel invoices received from emails.

Auto validates GSTIN and calculates GST split-up while employees file out-of-pocket expenses.

Auto prepares GST reports and pushes them into ERP.

Zero manual errors | Claim ITC on every Rupee spent | Stay GST compliant